About 'free vat accounting software'|FreeAgent Users: Dealing with the 20% VAT rate change

If you shop with a major bank, chances are that all the transactions in your account are scrutinized by AML (Anti Money Laundering) software. Billions of dollars are being invested in these applications. They are supposed to track suspicious transfers, deposits, and withdrawals based on overall statistical patterns. Bank directors, exposed, under the Patriot Act, to personal liability for money laundering in their establishments, swear by it as a legal shield and the holy grail of the on-going war against financial crime and the finances of terrorism. Quoted in Wired.com, Neil Katkov of Celent Communications, pegs future investments in compliance-related activities and products by American banks alone at close to $15 billion in the next 3 years (2005-2008). The United State's Treasury Department's Financial Crimes Enforcement Network (finCEN) received c. 15 million reports in each of the years 2003 and 2004. But this is a drop in the seething ocean of illicit financial transactions, sometimes egged on and abetted even by the very Western governments ostensibly dead set against them. Israel has always turned a blind eye to the origin of funds deposited by Jews from South Africa to Russia. In Britain it is perfectly legal to hide the true ownership of a company. Underpaid Asian bank clerks on immigrant work permits in the Gulf states rarely require identity documents from the mysterious and well-connected owners of multi-million dollar deposits. Hawaladars continue plying their paperless and trust-based trade - the transfer of billions of US dollars around the world. American and Swiss banks collaborate with dubious correspondent banks in off shore centres. Multinationals shift money through tax free territories in what is euphemistically known as "tax planning". Internet gambling outfits and casinos serve as fronts for narco-dollars. British Bureaux de Change launder up to 2.6 billion British pounds annually. The 500 Euro note makes it much easier to smuggle cash out of Europe. A French parliamentary committee accused the City of London of being a money laundering haven in a 400 page report. Intelligence services cover the tracks of covert operations by opening accounts in obscure tax havens, from Cyprus to Nauru. Money laundering, its venues and techniques, are an integral part of the economic fabric of the world. Business as usual? Not really. In retrospect, as far as money laundering goes, September 11 may be perceived as a watershed as important as the precipitous collapse of communism in 1989. Both events have forever altered the patterns of the global flows of illicit capital. What is Money Laundering? Strictly speaking, money laundering is the age-old process of disguising the illegal origin and criminal nature of funds (obtained in sanctions-busting arms sales, smuggling, trafficking in humans, organized crime, drug trafficking, prostitution rings, embezzlement, insider trading, bribery, and computer fraud) by moving them untraceably and investing them in legitimate businesses, securities, or bank deposits. But this narrow definition masks the fact that the bulk of money laundered is the result of tax evasion, tax avoidance, and outright tax fraud, such as the "VAT carousel scheme" in the EU (moving goods among businesses in various jurisdictions to capitalize on differences in VAT rates). Tax-related laundering nets between 10-20 billion US dollars annually from France and Russia alone. The confluence of criminal and tax averse funds in money laundering networks serves to obscure the sources of both. The Scale of the Problem According to a 1996 IMF estimate, money laundered annually amounts to 2-5% of world GDP (between 800 billion and 2 trillion US dollars in today's terms). The lower figure is considerably larger than an average European economy, such as Spain's. The System It is important to realize that money laundering takes place within the banking system. Big amounts of cash are spread among numerous accounts (sometimes in free economic zones, financial off shore centers, and tax havens), converted to bearer financial instruments (money orders, bonds), or placed with trusts and charities. The money is then transferred to other locations, sometimes as bogus payments for "goods and services" against fake or inflated invoices issued by holding companies owned by lawyers or accountants on behalf of unnamed beneficiaries. The transferred funds are re-assembled in their destination and often "shipped" back to the point of origin under a new identity. The laundered funds are then invested in the legitimate economy. It is a simple procedure - yet an effective one. It results in either no paper trail - or too much of it. The accounts are invariably liquidated and all traces erased. Why is It a Problem? Criminal and tax evading funds are idle and non-productive. Their injection, however surreptitiously, into the economy transforms them into a productive (and cheap) source of capital. Why is this negative? Because it corrupts government officials, banks and their officers, contaminates legal sectors of the economy, crowds out legitimate and foreign capital, makes money supply unpredictable and uncontrollable, and increases cross-border capital movements, thereby enhancing the volatility of exchange rates. A multilateral, co-ordinated, effort (exchange of information, uniform laws, extra-territorial legal powers) is required to counter the international dimensions of money laundering. Many countries opt in because money laundering has also become a domestic political and economic concern. The United Nations, the Bank for International Settlements, the OECD's FATF (Financial Action Task Force), the EU, the Council of Europe, the Organisation of American States, all published anti-money laundering standards. Regional groupings were formed (or are being established) in the Caribbean, Asia, Europe, southern Africa, western Africa, and Latin America. Money Laundering in the Wake of the September 11 Attacks Regulation The least important trend is the tightening of financial regulations and the establishment or enhancement of compulsory (as opposed to industry or voluntary) regulatory and enforcement agencies. New legislation in the US which amounts to extending the powers of the CIA domestically and of the DOJ extra-territorially, was rather xenophobically described by a DOJ official, Michael Chertoff, as intended to "make sure the American banking system does not become a haven for foreign corrupt leaders or other kinds of foreign organized criminals." Privacy and bank secrecy laws have been watered down. Collaboration with off shore "shell" banks has been banned. Business with clients of correspondent banks was curtailed. Banks were effectively transformed into law enforcement agencies, responsible to verify both the identities of their (foreign) clients and the source and origin of their funds. Cash transactions were partly criminalized. And the securities and currency trading industry, insurance companies, and money transfer services are subjected to growing scrutiny as a conduit for "dirty cash". Still, such legislation is highly ineffective. The American Bankers' Association puts the cost of compliance with the laxer anti-money-laundering laws in force in 1998 at 10 billion US dollars - or more than 10 million US dollars per obtained conviction. Even when the system does work, critical alerts drown in the torrent of reports mandated by the regulations. One bank actually reported a suspicious transaction in the account of one of the September 11 hijackers - only to be ignored. The Treasury Department established Operation Green Quest, an investigative team charged with monitoring charities, NGO's, credit card fraud, cash smuggling, counterfeiting, and the Hawala networks. This is not without precedent. Previous teams tackled drug money, the biggest money laundering venue ever, BCCI (Bank of Credit and Commerce International), and ... Al Capone. The more veteran, New-York based, El-Dorado anti money laundering Task Force (established in 1992) will lend a hand and share information. More than 150 countries promised to co-operate with the US in its fight against the financing of terrorism - 81 of which (including the Bahamas, Argentina, Kuwait, Indonesia, Pakistan, Switzerland, and the EU) actually froze assets of suspicious individuals, suspected charities, and dubious firms, or passed new anti money laundering laws and stricter regulations (the Philippines, the UK, Germany). A EU directive now forces lawyers to disclose incriminating information about their clients' money laundering activities. Pakistan initiated a "loyalty scheme", awarding expatriates who prefer official bank channels to the much maligned (but cheaper and more efficient) Hawala, with extra baggage allowance and special treatment in airports. The magnitude of this international collaboration is unprecedented. But this burst of solidarity may yet fade. China, for instance, refuses to chime in. As a result, the statement issued by APEC in November 2001 on measures to stem the finances of terrorism was lukewarm at best. And, protestations of close collaboration to the contrary, Saudi Arabia has done nothing to combat money laundering "Islamic charities" (of which it is proud) on its territory. Still, a universal code is emerging, based on the work of the OECD's FATF (Financial Action Task Force) since 1989 (its famous "40 recommendations") and on the relevant UN conventions. All countries are expected by the West, on pain of possible sanctions, to adopt a uniform legal platform (including reporting on suspicious transactions and freezing assets) and to apply it to all types of financial intermediaries, not only to banks. This is likely to result in... The Decline of off Shore Financial Centres and Tax Havens By far the most important outcome of this new-fangled juridical homogeneity is the acceleration of the decline of off shore financial and banking centres and tax havens. The distinction between off-shore and on-shore will vanish. Of the FATF's "name and shame" blacklist of 19 "black holes" (poorly regulated territories, including Israel, Indonesia, and Russia) - 11 have substantially revamped their banking laws and financial regulators. Coupled with the tightening of US, UK, and EU laws and the wider interpretation of money laundering to include political corruption, bribery, and embezzlement - this would make life a lot more difficult for venal politicians and major tax evaders. The likes of Sani Abacha (late President of Nigeria), Ferdinand Marcos (late President of the Philippines), Vladimiro Montesinos (former, now standing trial, chief of the intelligence services of Peru), or Raul Salinas (the brother of Mexico's President) - would have found it impossible to loot their countries to the same disgraceful extent in today's financial environment. And Osama bin Laden would not have been able to wire funds to US accounts from the Sudanese Al Shamal Bank, the "correspondent" of 33 American banks. Quo Vadis, Money Laundering? Crime is resilient and fast adapting to new realities. Organized crime is in the process of establishing an alternative banking system, only tangentially connected to the West's, in the fringes, and by proxy. This is done by purchasing defunct banks or banking licences in territories with lax regulation, cash economies, corrupt politicians, no tax collection, but reasonable infrastructure. The countries of Eastern Europe - Yugoslavia (Montenegro and Serbia), Macedonia, Ukraine, Moldova, Belarus, Albania, to mention a few - are natural targets. In some cases, organized crime is so all-pervasive and local politicians so corrupt that the distinction between criminal and politician is spurious. Gradually, money laundering rings move their operations to these new, accommodating territories. The laundered funds are used to purchase assets in intentionally botched privatizations, real estate, existing businesses, and to finance trading operations. The wasteland that is Eastern Europe craves private capital and no questions are asked by investor and recipient alike. The next frontier is cyberspace. Internet banking, Internet gambling, day trading, foreign exchange cyber transactions, e-cash, e-commerce, fictitious invoicing of the launderer's genuine credit cards - hold the promise of the future. Impossible to track and monitor, ex-territorial, totally digital, amenable to identity theft and fake identities - this is the ideal vehicle for money launderers. This nascent platform is way too small to accommodate the enormous amounts of cash laundered daily - but in ten years time, it may. The problem is likely to be exacerbated by the introduction of smart cards, electronic purses, and payment-enabled mobile phones. In its "Report on Money Laundering Typologies" (February 2001) the FATF was able to document concrete and suspected abuses of online banking, Internet casinos, and web-based financial services. It is difficult to identify a customer and to get to know it in cyberspace, was the alarming conclusion. It is equally complicated to establish jurisdiction. Many capable professionals - stockbrokers, lawyers, accountants, traders, insurance brokers, real estate agents, sellers of high value items such as gold, diamonds, and art - are employed or co-opted by money laundering operations. Money launderers are likely to make increased use of global, around the clock, trading in foreign currencies and derivatives. These provide instantaneous transfer of funds and no audit trail. The underlying securities involved are susceptible to market manipulation and fraud. Complex insurance policies (with the "wrong" beneficiaries), and the securitization of receivables, leasing contracts, mortgages, and low grade bonds are already used in money laundering schemes. In general, money laundering goes well with risk arbitraging financial instruments. Trust-based, globe-spanning, money transfer systems based on authentication codes and generations of commercial relationships cemented in honour and blood - are another wave of the future. The Hawala and Chinese networks in Asia, the Black Market Peso Exchange (BMPE) in Latin America, other evolving courier systems in Eastern Europe (mainly in Russia, Ukraine, and Albania) and in Western Europe (mainly in France and Spain). In conjunction with encrypted e-mail and web anonymizers, these networks are virtually impenetrable. As emigration increases, diasporas established, and transport and telecommunications become ubiquitous, "ethnic banking" along the tradition of the Lombards and the Jews in medieval Europe may become the the preferred venue of money laundering. September 11 may have retarded world civilization in more than one way. Asset Confiscation and Asset Forfeiture The abuse of asset confiscation and forfeiture statutes by governments, law enforcement agencies, and political appointees and cronies throughout the world is well-documented. In many developing countries and countries in transition, assets confiscated from real and alleged criminals and tax evaders are sold in fake auctions to party hacks, cronies, police officers, tax inspectors, and relatives of prominent politicians at bargain basement prices. That the assets of suspects in grave crimes and corruption should be frozen or "disrupted" until they are convicted or exonerated by the courts - having exhausted their appeals - is understandable and in accordance with the Vienna Convention. But there is no justification for the seizure and sale of property otherwise. In Switzerland, financial institutions are obliged to automatically freeze suspect transactions for a period of five days, subject to the review of an investigative judge. In France, the Financial Intelligence Unit can freeze funds involved in a reported suspicious transaction by administrative fiat. In both jurisdictions, the fast track freezing of assets has proven to be a more than adequate measure to cope with organized crime and venality. The presumption of innocence must fully apply and due process upheld to prevent self-enrichment and corrupt dealings with confiscated property, including the unethical and unseemly use of the proceeds from the sale of forfeited assets to close gaping holes in strained state and municipal budgets. In the United States, according to The Civil Asset Forfeiture Reform Act of 2000 (HR 1658), the assets of suspects under investigation and of criminals convicted of a variety of more than 400 minor and major offenses (from soliciting a prostitute to gambling and from narcotics charges to corruption and tax evasion) are often confiscated and forfeited ("in personam, or value-based confiscation"). Technically and theoretically, assets can be impounded or forfeited and disposed of even in hitherto minor Federal civil offenses (mistakes in fulfilling Medicare or tax return forms) The UK's Assets Recovery Agency (ARA) that is in charge of enforcing the Proceeds of Crime Act 2002, had this chilling statement to make on May 24, 2007: "We are pursuing the assets of those involved in a wide range of crime including drug dealing, people trafficking, fraud, extortion, smuggling, control of prostitution, counterfeiting, benefit fraud, tax evasion and environmental crimes such as illegal dumping of waste and illegal fishing." (!) Drug dealing and illegal fishing in the same sentence. The British firm Bentley-Jennison, who provide Forensic Accounting Services, add: "In some cases the defendants will even have their assets seized at the start of an investigation, before any charges have been considered. In many cases the authorities will assume that all of the assets held by the defendant are illegally obtained as he has a "criminal lifestyle". It is then down to the defendant to prove otherwise. If the defendant is judged to have a criminal lifestyle then it will be assumed that physical assets, such as properties and motor vehicles, have been acquired through the use of criminal funds and it will be necessary to present evidence to contradict this. The defendant's bank accounts will also be scanned for evidence of spending and any expenditure on unidentified assets (and in some cases identified assets) is also likely to be included as alleged criminal benefit. This often leads to the inclusion of sums from legitimate sources and double counting both of which need to be eliminated." Under the influence of the post-September 11 United States and the FATF (Financial Action Task Force on Money Laundering), Canada, Australia, the United Kingdom, Greece, South Korea, and Russia have similar asset recovery and money laundering laws in place. International treaties (for instance, the 1959 European Convention on Mutual Legal Assistance in Criminal Matters, the 1990 Convention of the Council of Europe on Laundering, Search, Seizure and Confiscation of the Proceeds from Crime (ETS 141), and The U.N. Convention against Corruption 2003- UNCAC) and European Union Directives (e.g., 2001/97/EC) allow the seizure and confiscation of the assets and "unexplained wealth" of criminals and suspects globally, even if their alleged or proven crime does not constitute an offense where they own property or have bank accounts. This abrogation of the principle of dual criminality sometimes leads to serious violations of human and civil rights. Hitler could have used it to ask the United Kingdom's Assets Recovery Agency (ARA) to confiscate the property of refugee Jews who committed "crimes" by infringing on the infamous Nuremberg race laws. Only offshore tax havens, such as Andorra, Antigua, Aruba, the British Virgin Islands, Guernsey, Monaco, the Netherlands Antilles, Samoa, St. Vincent, the US Virgin Islands, and Vanuatu still resist the pressure to join in the efforts to trace and seize suspects' assets and bank accounts in the absence of a conviction or even charges. Even worse, unlike in other criminal proceedings, the burden of proof is on the defendant who has to demonstrate that the source of the funds used to purchase the confiscated or forfeited assets is legal. When the defendant fails to furnish such evidence conclusively and convincingly, or if he has left the United States or had died, the assets are sold at an auction and the proceeds usually revert to various law enforcement agencies, to the government's budget, or to good social causes and programs. This is the case in many countries, including United Kingdom, United States, Germany, France, Hong Kong, Italy, Denmark, Belgium, Austria, Greece, Ireland, New Zealand, Singapore and Switzerland. According to a brief written by Jack Smith, Mark Pieth, and Guillermo Jorge at the Basel Institute on Governance, International Centre for Asset Recovery: "Article 54(1)(c) of the UNCAC recommends that states parties establish non-criminal systems of confiscation, which have several advantages for recovery actions: the standard of evidence is lower ("preponderance of the evidence" rather than "beyond a reasonable doubt"); they are not subject to some of the more restrictive traditional safeguards of international cooperation such as the offense for which the defendant is accused has to be a crime in the receiving state (dual criminality); and it opens more formal avenues for negotiation and settlements. This is already the practice in some jurisdictions such as the US, Ireland, the UK, Italy, Colombia, Slovenia, and South Africa, as well as some Australian and Canadian States." In most countries, including the United Kingdom, the United States, Austria, Germany, Indonesia, Macedonia, and Ireland, assets can be impounded, confiscated, frozen, forfeited, and even sold prior to and without any criminal conviction. In Australia, Austria, Ireland, Hong-Kong, New Zealand, Singapore, United Kingdom, South Africa, United States and the Netherlands alleged and suspected criminals, their family members, friends, employees, and partners can be stripped of their assets even for crimes they have committed in other countries and even if they have merely made use of revenues obtained from illicit activities (this is called "in rem, or property-based confiscation"). This often gives rise to cases of double jeopardy. Typically, the defendant is notified of the impending forfeiture or confiscation of his or her assets and has recourse to a hearing within the relevant law enforcement agency and also to the courts. If he or she can prove "substantial harm" to life and business, the property may be released to be used, though ownership is rarely restored. When the process of asset confiscation or asset forfeiture is initiated, banking secrecy is automatically lifted and the government indemnifies the banks for any damage they may suffer for disclosing confidential information about their clients' accounts. In many countries from South Korea to Greece, lawyer-client privilege is largely waived. The same requirements of monitoring of clients' activities and reporting to the authorities apply to credit and financial institutions, venture capital firms, tax advisers, accountants, and notaries. Elsewhere, there are some other worrying developments: In Bulgaria, the assets of tax evaders have recently begun to be confiscated and turned over to the National Revenue Agency and the State Receivables Collection Agency. Property is confiscated even when the tax assessment is disputed in the courts. The Agency cannot, however, confiscate single-dwelling houses, bank accounts up to 250 leva of one member of the family, salary or pension up to 250 leva a month, social care, and alimony, support money or allowances. Venezuela has recently reformed its Organic Tax Code to allow for: " (P)re-judgment enforcement measures (to) include closure of premises for up to ten days and confiscation of merchandise. These measures will be applied in addition to the attachment or sequestration of personal property and the prohibition against alienation or encumbrance of realty. During closure of premises, the employer must continue to pay workers, thereby avoiding an appeal for constitutional protection." Finally, in many states in the United States, "community responsibility" statutes require of owners of legal businesses to "abate crime" by openly fighting it themselves. If they fail to tackle the criminals in their neighborhood, the police can seize and sell their property, including their apartments and cars. The proceeds from such sales accrue to the local municipality. In New-York City, the police confiscated a restaurant because one of its regular patrons was an alleged drug dealer. In Alabama, police seized the home of a senior citizen because her yard was used, without her consent, for drug dealing. In Maryland, the police confiscated a family's home and converted it into a retreat for its officers, having mailed one of the occupants a package of marijuana. |

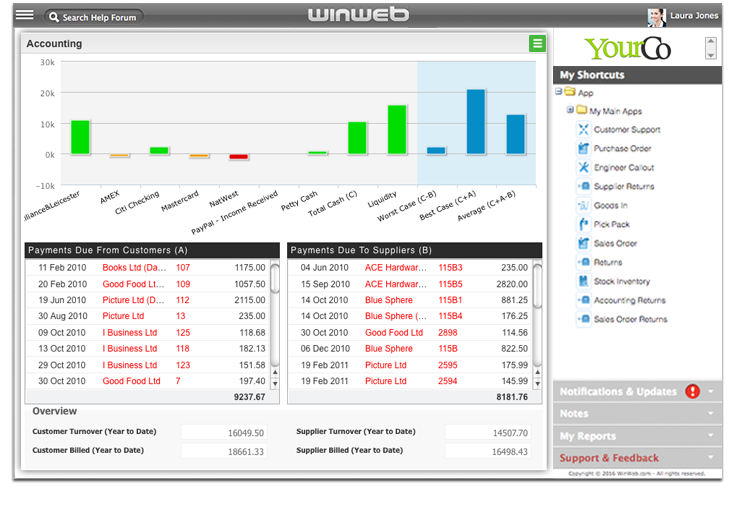

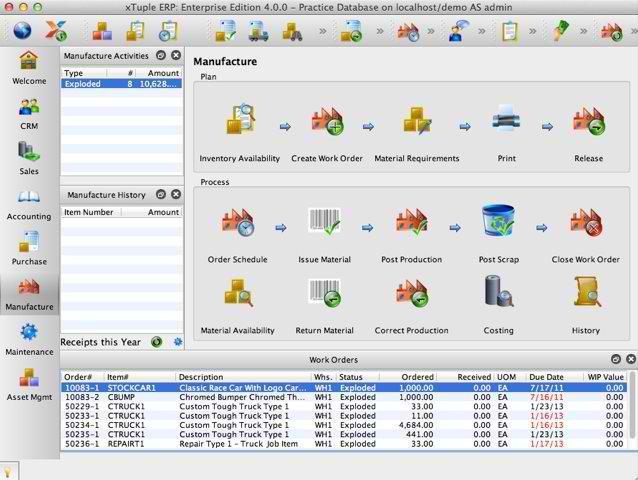

Image of free vat accounting software

free vat accounting software Image 1

free vat accounting software Image 2

free vat accounting software Image 3

free vat accounting software Image 4

free vat accounting software Image 5

Related blog with free vat accounting software

- muftmaal.blogspot.com/...Accounting, Inventory Management With Payroll, VAT, Service Tax, TDS, FBT, POS & Excise Tally 9 is the Most populer financial accounting software in India. Tally 9 is a multilingual...

- siliconbullet.wordpress.com/... in order to free up disk space. You can choose...and performance of your Sage software. For more Good ... in Sage Accounts . Share this: Twitter Facebook...

- imeall.wordpress.com/...to Aileen from Aisling Software for explaining... to VAT returns...it’s downloadable for free and it’s fully functional...competitor, Sage Instant Accounts is ...

- leonstolarski.blogspot.com/...accounts to complete. The VAT return doesn't normally prove... you with. The Company accounts, on the other hand, always prove... of our bookkeeping software and the fact that we ...

- freeabookkeepingsoftware.blogspot.com/... or clubs: also administrate the VAT of amounts Protect your files...Cash Manager Source and information : http://www.moor-software.com/cash/page.php?page=welkom〈=0

- oneaccounting.wordpress.com/... with manual VAT adjustments. One Accounting are one of...accounting software after gaining...information or would like a free 30 day trial with...

- earlofbedlam.blogspot.com/... are also VAT free. Mr G seemed...he asked, "What accounting software package do you use... to an account of the Village Fete, it...

- oneaccounting.wordpress.com/...like more information or would like a free 30 day trial of FreeAgent accounting software then please do not hesitate to contact... 2011 Tagged: | freeagent , vat rate change

- ccptax.wordpress.com/...acceptable form to you or us (as your accountant) in order to complete all statutory... evaluation copy if possible (many software vendors offer a free 30-day trial), and also go and see...

- software-tech-review.blogspot.com/...feature available in this restaurant software. You will have multiple ...tax systems (USA, VAT, PST, GST and many more). It... overview of the accounting work. You will track what's...

Related Video with free vat accounting software

free vat accounting software Video 1

free vat accounting software Video 2

free vat accounting software Video 3