About 'accounting in tally'|Print after Save Invoice in Tally

*Note: This was written by a Yahoo! contributor. Sign up with the Yahoo! Contributor Network to start publishing your own finance articles. Contract and freelance workers often have the benefit of being their own boss, setting their own hours and even making their own rules. When it comes to paying taxes, the IRS allows for many deductions and ways to file your returns. However, as you probably don't have taxes taken out of your payments, it's easy to get into trouble and rack up a big tax liability at the end of the year. As the owner of several small businesses and as someone who has been involved in an IRS audit, I know the secret is both accurate record keeping and good preparation. I've also found the IRS phone support people extremely knowledgeable and helpful, although it can take a while to reach one. Here are some basic tax tips to help independent contractors: Know The Rules The IRS rules and regulations are complicated and detailed but they can also be used to your benefit. Those same rules and regulations offer a very wide array of deductible expenses for contract and freelance workers, almost everything you have to buy or use specifically for your business is deductible. Nothing in the tax code says you must pay more tax than required. It's your responsibility to know the law and rules so you are able to pay only the amount required by law, and not a penny more. Keep Good Records This might be the best piece of overall advice. Keep ALL receipts. If they don't show all the details, make a note of anything missing. Keep a log of your mileage, including destination and reasons for travel. If you plan to deduct any travel or entertainment expenses, be sure to note who you were with, and how the discussion related to business. Keep receipts neatly filed, the best method being to input them frequently into a accounting program. You can also create simple spreadsheets with the receipts listed, coded by details or type of expense and the totals. Prepare for that Income As a freelance or contract worker, you can expect a 1099-MISC (or similar form) in late January from anyone who has made payments to you over the year. Remember, it's your responsibility to report all income to the IRS, regardless of whether you were sent a 1099 or other official form. If you received income, it must be reported. Before the end of the year, go through your files and add up all the payments so you have an idea what to expect and are not surprised by the total paid to you. You may also want to do some rough calculations of your tax liability, as you may find you can spend some more money on business expenses with full reimbursement and to lower that tax liability. You may also find making large purchases are helpful for you if you do them before the end of the year. If you wait until 2011 when you "do your taxes" it will be too late. Use Quarterly Payments If you have a large tax liability this year and have to make a large payment, check about making estimated payments next year. They allow you to estimate the tax you will owe, based on past experience and make quarterly payments towards the amount owing. This will prevent you from getting hit with a big bill at the end of the year and help you better plan your cash flow. Get Professional Help We all know there is a range of automated tax programs and software. Some will even integrate automatically with your accounting software, using all the data you have already entered. The IRS rules are complicated and change constantly. Sure, computer programs can be updated, but they are not a real substitute for a CPA. As a small business owner, I try to do the majority of the work myself. I tally up all the receipts and revenue and prepare detailed reports showing the totals. I also know which forms should be filed for our LLC and for my personal returns. However, I still like to use a professional, just as I use a doctor for medical situations and a lawyer for legal situations, no matter how much I think I know myself. The time I spend doing all the data entry and basic calculations allows me to use a top CPA, who I cannot afford to do my whole taxes from start to finish, but I can afford him to review my totals and make sure I am taking advantage of every available deduction. I also rely on his knowledge and experience to prepare the final return and make sure the big picture stuff works for me. An experienced CPA can also help in the event of an audit and just really let you know what is appropriate and normal and how far you may be able to "push the envelope" without getting into trouble. More from this contributor: Business Advice From a CEO Retirement Advice From The Recently Retired Tips For Keeping Your Cool While Under Work Pressure |

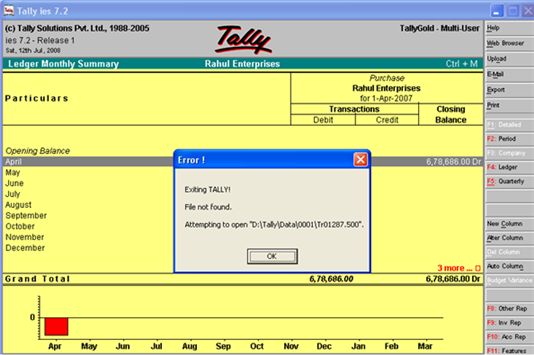

Image of accounting in tally

accounting in tally Image 1

accounting in tally Image 2

accounting in tally Image 3

accounting in tally Image 4

accounting in tally Image 5

Related blog with accounting in tally

- bfsisector.wordpress.com/...Knowledge in PF, ESIC, TDS, and Service Tax & Tally 7.2 . * Proficient in MS Excel . * Good Communication skills...pm and is filed under Account Executive , Pune , Tally , YelloJobs...

- unicomtech.blogspot.com/...in voucher entry F1: To access Accounting buttons in voucher entry F1: To Select ... company From Gateway of Tally. It will show you list of ...

- fastworking.blogspot.com/...As everyone know that tally has captured lot of market in accounting. No doubt that this software...Company and Save WITH Ctr+A. In this way you have ...

- gsoftnet.blogspot.com/...useful & important Tips for 7.2 Tally Accounting Software users, which are... for you to create ledger in voucher entry level. For this you have...

- tallycoaching.wordpress.com/...a regular task of accounting. In Tally.ERP 9, Reconciliation...my previous experience in accounts and computer knowledge...able to teach the tally software course to...

- fastworking.blogspot.com/To protect data, Tally Accounting Software provides Backup facility in tally by default. As we...etc. Before running tally in a day and running...

- fastworking.blogspot.com/...in which you want to set interest calculation. 2) Press "V" Button for selecting "Accounting Voucher" in Gateway of Tally. 3) Press F11 and set as under :- "Activate Interest Calculation" = Yes "(use Advanced...

- fastworking.blogspot.com/...you know that you can set print option Yes in tally after saving of any invoice. There...invoice after Saving Gateway of Tally > Account info > Voucher Types > Alter > ...

- kenyanjobs.blogspot.com/... CPA Part II or above, with 2 years experience, preferably in a construction company Tally accounting software would be an added advantage Candidates for the above...

- kenyanjobs.blogspot.com/...Must be over 25-35 years old CPA K Must have OVER 5 years experience TALLY ACCOUNTING Salary negotiable Send Cv’s urgently to cvkentrain@gmail.com copy info@kentrain.co.ke subject...

Accounting In Tally - Blog Homepage Results

A Blog on harnessing the power of the Tally accounting package. The possibilities in Tally customization, and integrating it with other software packages.

antkot88by

... below or click an icon to log in: Email (required) (Not ... using your WordPress.com account. ( Log Out / Change ) You are...

... Blogroll Cablog – A taxi driver's account of Sydney City Observationist Rocco Bloggo – Sydney in cartoons The Art Life – Sydney Art The Tally Room A political blog Meta Register Log in...

Related Video with accounting in tally

accounting in tally Video 1

accounting in tally Video 2

accounting in tally Video 3

0 개의 댓글:

댓글 쓰기